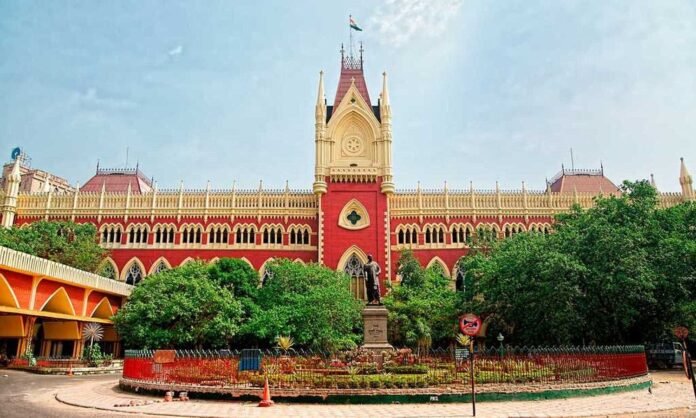

Calcutta High Court rules ITR as reliable proof of income in motor accident claims, awarding ₹39 lakh compensation. | The Legal Observer

In a significant ruling for motor accident compensation jurisprudence, the Calcutta High Court has reaffirmed that a victim’s Income Tax Return (ITR) is a reliable and authentic indicator of actual earnings.

Calcutta High Court Reaffirms ITR as Key Evidence in Assessing Income

The Calcutta High Court has held that when an Income Tax Return is duly filed and accepted by tax authorities, it must be treated as credible evidence of a victim’s income while determining compensation in motor accident claims. The judgment—delivered by Justice Biswaroop Chowdhury—resulted in ₹39 lakh compensation awarded to the bereaved parents of a young accident victim.

According to the Court, ITRs represent a formal and verified disclosure of earnings, endorsed by the Income Tax Department. Therefore, unless contradicted by stronger evidence, they serve as the most trustworthy basis for evaluating a claimant’s income during proceedings under the Motor Vehicles Act, 1988, particularly under Sections 166 and 168, which govern compensation determination and the Tribunal’s powers.

This reinforces the legal understanding that ITRs cannot be dismissed without valid reasons, and ensures uniformity in compensation assessments across tribunals.

Bench Emphasises Reliability of Accepted ITRs

While examining the compensation claim filed by the victim’s parents, the Court reiterated that an accepted ITR reflects a taxpayer’s verified financial profile. Justice Chowdhury paraphrased the principle: once the Income Tax Department has accepted an ITR as genuine, courts should ordinarily rely on it unless compelling reasons exist to reject it.

The Court observed that many Motor Accident Claims Tribunals (MACTs) often resort to speculative assessments or adopt notional income figures even when authenticated ITRs are available. This, the High Court cautioned, leads to unfair outcomes for dependents who rely on accurate income determination to secure just compensation.

By recognising the ITR as authentic documentary proof, the Court restored consistency in assessing loss of income, future prospects, and compensation calculations across MACT decisions.

Readers can explore related judicial updates on The Legal Observer’s news section available at the National News category at https://thelegalobserver.com/category/news/national/.

Compensation Set at ₹39 Lakh After Fresh Assessment

The Court recalculated the victim’s earnings based on the most recently filed ITR prior to the accident. Using the multiplier method under Section 168 of the Motor Vehicles Act, deductions for personal expenses, and standardised guidelines for future prospects laid down by the Supreme Court, the High Court concluded that the appropriate compensation payable to the parents amounted to ₹39 lakh.

The insurer’s contention that the ITR was “inflated” or “not reflective of stable income” was rejected. The Court emphasised that once an ITR passes the scrutiny of income tax authorities, it carries statutory sanctity.

To understand more about how compensation is structured, readers may refer to insights published on The Legal Observer’s Most Popular section, accessible through the platform’s homepage at https://thelegalobserver.com/.

Application of Motor Vehicles Act: Sections 166 & 168 Explained

The Court highlighted the significance of Section 166, which empowers dependents of a deceased victim to seek compensation for loss of income, loss of estate, and other damages.

Meanwhile, Section 168 requires the Tribunal to award “just compensation” based strictly on evidence. In this context, the High Court clarified that ITRs form part of such evidence and should be given primacy over rough estimates or conjectural figures.

This guidance serves as an important corrective step, especially when MACT orders frequently face criticism for inconsistent income calculations.

For deeper legal insights and expert commentary, readers can also visit the Insight section at https://thelegalobserver.com/category/views/insight/.

Strengthening Transparency and Fairness in Compensation Law

The High Court’s decision aligns with broader principles of transparency and factual accuracy emphasised by leading journalism and legal reporting standards. It also adds clarity for insurance companies, dependents, and tribunals in future cases.

The ruling encourages litigants to maintain authentic documentation of income and reassures families seeking compensation that the judicial process relies on verified, government-endorsed records—not arbitrary estimates.

A relevant explanatory video on compensation law can be found on The Legal Observer’s official YouTube channel at https://www.youtube.com/@thelegalobserver.

For additional queries or legal assistance, readers may connect via the Legal Helpline page at https://thelegalobserver.com/category/legal-helpline/.